File a Complaint Against

Ares Acquisitions

Know Your Options and Recover Your Funds

Caution Investors!

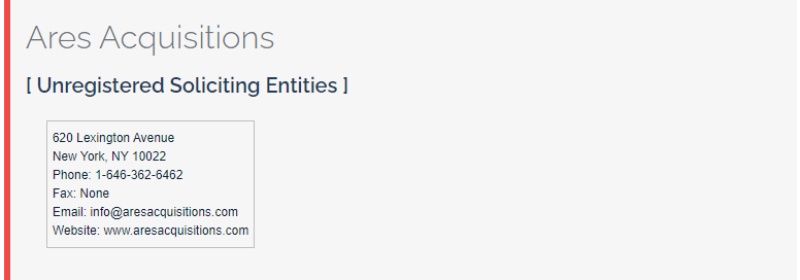

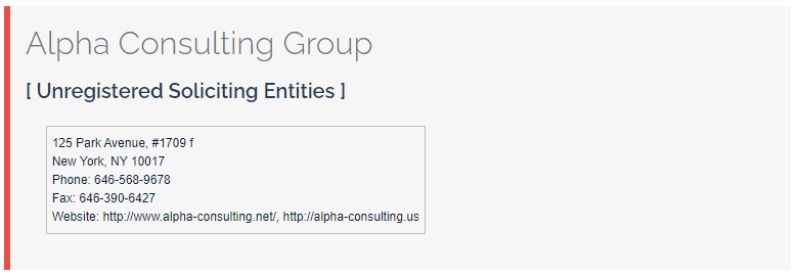

- Entities: Ares Acquisitions

- SEC Warning: Unregistered Soliciting Entities

- Date: 2024/01/23

- Location: 620 Lexington Avenue, New York, NY 10022

- Phone: 1-646-362-6462

- Fax: None

- Email: [email protected]

- Website: www.aresacquisitions.com

- Caution Investors: Ares Acquisitions – Concerning the registration of the issuance, offer, or sale of securities/derivatives, as well as the associated reporting obligations

Overview of Ares Acquisitions

Ares Acquisitions is an unregulated investment platform. The problem with unregulated investment platforms is that they are not reliable and abuse regulations. Make sure to stay away from them as they are anonymous, and they can disappear at any time without notice. Companies providing online investment services without a license cannot provide their clients with any sort of protection.

Regulation and Compliance of Ares Acquisitions

The Securities and Exchange Commission (SEC) has released a report addressing the proliferation of fraudulent entities targeting investors. These entities falsely claim registration, licensing, or affiliation with US regulators or non-existent international organizations. The report identifies three types of fraudulent activities: unregistered soliciting entities, fictitious regulators, and impersonators of genuine firms. It provides details such as website addresses, contact information, and solicitation methods used by these entities. Investors are advised to verify the legitimacy of any soliciting entity through the SEC’s EDGAR database and FINRA’s BrokerCheck system and to report suspicious activities to the SEC. The SEC will continue to investigate and update the report accordingly.

Ares Acquisitions is unregulated and most likely illegal, which ultimately means that your funds will be in danger if you deposit. So, yet again, there is another reason to stay away from Ares Acquisitions.

As there is no regulation, the people running the platform can pocket your money without bearing any responsibility for their criminal actions. They can disappear anytime without notice. Companies providing online investment services without a license cannot provide their clients with any sort of protection. In contrast, regulated firms are required by law to adhere to a slew of regulations that ensure the safety of clients’ funds. For example, in most jurisdictions, a company will get a license if it meets the minimum capital requirements that vary by country and may also depend on the product specification, business classification, and so on.

To make sure you are dealing with a regulated and known investment platform, you should be able to find easily who the CEO of this investment firm is, who is running it, etc. Lack of information is a big red flag since you don’t know who will be dealing with your money. This is the reason why they are dangerous to deal with.

On top of that, once you click and provide them with your email and contact number, they will ring you immediately and promise you anything to make you deposit money with them as fast as possible. Most scammers are experienced manipulators, and before you know it, they’ll ask for your bank card numbers to assist you with the deposit. You shouldn’t provide this information, as there is also a chance to become a victim of identity theft, experiencing many more problems consequently.

Ares Acquisitions Customer Reviews

Depending on the amount of experience people have with investment platforms, it may be easy to tell what is legitimate and off-base before the problem starts. However, most of you may not be aware that a problem is problematic before you already sign up. If they show any of these signs, either avoid them entirely or look very carefully before proceeding.

– Not regulated

– High fees and commissions

– Not enough information on the website

– Poor communication and refusal to answer questions

– Pushy manner

– Keeps mentioning rules and fees that were not outlined in the contract

– Does not let you withdraw money from your account

Products and Services Offered By Ares Acquisitions

Ares Acquisitions is not safe, and we say so because it’s an unregulated investment platform. These schemes are never secure. They always promise things they won’t deliver, and Ares Acquisitions makes no exception. They claim that customers can earn big money, which is a scam offer from any viewpoint. Such promises are ludicrous, and they show that Ares Acquisitions is a suspected scam you should avoid. Beware!

Ares Acquisitions Customer Support

Ares Acquisitions allows you to contact them through telephone contact and email. They do not provide any location. There is no certainty in the contact information available. However, fraudsters cut off communications upon receiving your money. It is impossible to deliver a friendly interface without proper customer relations. Active customer support assists in determining more trust in the company.

Are Funds Safe with Ares Acquisitions?

With such a lack of information and Ares Acquisitions being unregulated, funds are not safe. The security of funds is a huge problem with unregulated investment platforms. A red flag that we noticed is that they are withholding vital information from users. They could go bankrupt from one day to another since there is no banking information about them.

They do not guarantee the security of funds. The safety of your money is a top factor to consider in any platform. Any red flag is a warning you should not ignore. Investing your money with anonymous platforms not only puts your money at risk, but your data may fall into the wrong hands, attracting criminal activities during the registration process.

The point at which many of our clients realize they are dealing with scam brokers is when they request to withdraw all funds, and the broker either won’t allow them or will make it difficult. They may employ the following tactics:

– Aggressively urge clients to make additional trades. The client often acquiesces because the broker will be quite pushy and make it clear he or she is in control since they holds the client’s funds.

– Will charge high withdrawal fees. Many clients will instead try to make more money to cover these high fees and will make more transactions instead of withdrawing.

– Cease communication. They may be evasive or simply not communicate at all.

If Ares Acquisitions is doing any of these things to avoid releasing your funds, contact our experts today.

Conclusion

Ares Acquisitions is an unregulated platform to avoid. Their investment method is unreliable. Unregulated investment scams, in particular, are usually operated anonymously. Sooner or later, the service will inevitably close. They usually target traders and investors with little or no experience by promising fictitious investment opportunities. You’d better stay far away from unregulated entities and trade with regulated platforms only.

There are also insolvency protections that unregulated platforms do not have access to if they go bust.

Platforms that are not registered with or regulated by a regulatory organization are considered unregulated. Because they are not subject to any laws or restrictions imposed by financial regulatory organizations, they are free to trade as they see fit. Choosing unlicensed platforms comes with its own set of disadvantages.

If you have been scammed, leave a comment, or if you wish to arrange a free consultation, feel free to submit your complaint by clicking the button below.