File a Complaint Against

ExCentral/OM Bridge

Know Your Options and Recover Your Funds

It’s usually sound advice to tell someone who wants to invest to check a broker’s license. However, even if a broker has a license, that’s no guarantee that they are trustworthy.

One thing that makes licenses useful is the ability to revoke them, if necessary. Thankfully, for most brokers, this doesn’t need to happen. Since licenses require a lot of paperwork, red tape, and fees, once licensed, financial companies aren’t usually motivated to behave in a way that would cause them to lose their license.

However, the concept of a license isn’t useful if it can’t be canceled or not reissued. Regulations mean nothing if those that fall under their jurisdiction aren’t put to the test from time to time or deprived of their license if they’ve not been providing service that conforms to high standards.

OM Bridge Ltd, which runs ExCentral, has been stripped of its license by the South African financial regulator FSCA. This is only the first step in an ongoing process, as it seems the EU has canceled ExCentral’s license. According to the website, ExCentral also has a license from CySEC the Cypriot authorities.

What Is the Relationship Between OM Bridge and Ex Central?

When we investigate broker scams, we often see aliases and shell companies. Many brokers establish different identities and shuffle funds from one to the other. This isn’t really what’s going on here.

Even though both OM Bridge and ExCentral have landed in trouble with regulators, this isn’t a shifty operation in which brokers assume different, secret identities to hide their activities. In fact, on the ExCentral site, the broker is very transparent about their parent company, location, and license.

OMBridge is the parent company of ExCentral. OMBridge is a financial services provider based in South Africa and has an FSCA license. ExCentral is the European subsidiary of OMBridge but it is operated directly under the company Mount Nico Corp Ltd. which was licensed by CySEC, the financial regulator of Cyprus, but this licensed has also been revoked (we’ll get to that later).

What Happened to OM Bridge?

OM Bridge was flagged by the FSCA because of the multitude of customer complaints. This is usually the reason a broker loses their license. Of course, anyone can write negative comments on review sites. However, regulators don’t remove a license unless the customers have been verified and their complaints have been proven. This must be the case with OM Bridge.

If OMBridge loses its license, that affects all of its subsidiaries. In its own statement, the FSCA doesn’t specify why exactly OM Bridge was penalized, but we can read between the lines. First, it emphasizes that OM Bridge was licensed only to act as an intermediary for the trading of derivative instruments. Although we aren’t sure, perhaps OM Bridge got caught offering trading of other products.

Derivative instruments are assets whose value is decided between two or more parties, and they include stocks, bonds, commodities, currencies, indices, and more. If OM Bridge offered trading of something that isn’t in this category, this would have been sufficient to lose their license.

Second, the FSCA said the complaints were from South African customers and those abroad. The fact that customers abroad were mentioned might imply OM Bridge accepted customers in regions they weren’t licensed to operate.

This suspicion was confirmed in an account that OM Bridge was banned by MAS, the Singapore regulatory authority. In spite of the ban, OM Bridge continued to recruit clients from Singapore.

Is ExCentral Paying for OM Bridge’s Sins or Is It a Separate Scam Broker

On the one hand, we could understand that the FSCA revoking OM Bridge’s license may put its subsidiary, ExCentral out of operation. On the other hand, the FSCA is one regulatory body and CySEC is another. We could imagine that EXCentral might have been able to weather this storm since it had a separate license from Cyprus. Also, it is run in Europe by a separate company called Mt. Nico Corp. Ltd.

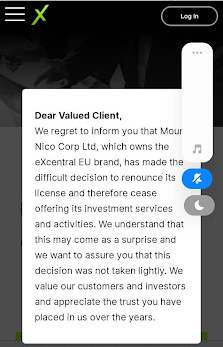

However, when we reached the ExCentral website, we saw the following message:

This is a fascinating, yet tangled, web. It seems that Mt Nico Corp. Ltd, which in its own right is a CySec-licensed financial firm, has “renounced” its license. This is a nice way of saying that it also has gotten in trouble with a regulator and has had its license revoked.

Mt. Nico Corp Ltd had to settle with CySec for its regulatory violations to the tune of €290,000 and as a result, ExCentral is no longer taking clients. According to Finance Magnates.com, Mt. Nico Corp’s regulatory lapses may have included issues with compliance, conflict of interest, safeguarding clients’ rights, and securing information.

Is it a coincidence that Ex Central was run by two formerly regulated financial entities that lost their licenses? Was there another relationship between Mt. Nico Corp and OM Bridge or did ExCentral just have bad luck?

The Hard Truth: Some Scam Brokers Have Licenses

Although we constantly issue the caveat that you are much safer with licensed brokers, a license is not a guarantee that you aren’t dealing with a broker scam. We have to say that 80-90% of the time a broker that is regulated is safe, but once in a while, we run into problems like Ex Central, and its shady managers OM Bridge and Mt. Nico Corp.

Don’t get lured into a false sense of security by claims a broker is licensed. Check the license is up-to-date. Go to the regulator’s website, and you should get the information. Even if the broker’s license is current, always be on the lookout.

If you run into trouble with a broker and they won’t allow you to withdraw your money, talk to Broker Complaint Registry. We have strategies that can improve your chances of fund recovery success.

If You Need Fund Recovery from ExCentral, Talk to Us

We create these reviews to warn consumers about brokers and schemes that may be fraudulent. If you have an account with this broker close it and request a withdrawal. If you are not given your money back, contact Broker Complaint Registry right away. We will consult with you, and work to track down your funds.