Scamming those who have been scammed! So-called recovery experts are scamming those who lost money to online trading scams.

Many individuals who have come across Broker Complaint Registry will, unfortunately, be accustomed to a whole gamut of fraudulent binary options and forex brokers that made up a large swath of the online trading industry. From fixing trades, denying withdrawals and enabling horrible trades, numerous brokers made millions conning innocent people of their hard-earned money.

Because of these aforementioned reasons, a number of regulatory authorities across the globe have now barred the sale of binary options to retail traders. Just a few weeks ago, for example, the European Securities and Markets Authority (ESMA) proclaimed that it would be extending its binary options ban for an additional three months.

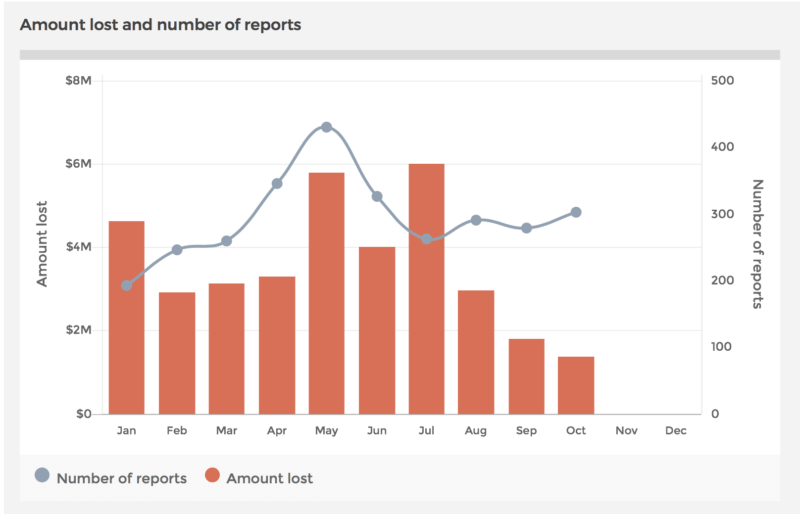

These sanctions may stop traders from being conned in the future but for those who have already lost their funds, it only provides minor solace. In fact, getting funds back from con-artists, who are almost completely anonymous, has been a challenge for most binary options other online trading scam victims.

Scam Recovery Service – The New Villain

Unfortunately a new sort of scammer – the so-called ‘recovery expert’ has come onto the scene. They specifically prey on those scam victims and often convince them to part with even more of their money and – they’re pretty good at it.

Finding these recovery scam-artists is not too difficult. Just take a look at the comments section of any news article pertaining to forex or binary options trading and you are likely to find a number of posts with the form of the following message: I lost a ton of money trading binary options with ‘xyz’ company, thankfully company X recovered my money for me – just email company X here to find out more.

Here at Broker Complaint Registry, we have discovered a number of fake recovery websites with the same layout: phony office addresses, fake US phone numbers, no license or regulation and no clear indication as to who actually works or runs the company.

One of these companies, Finance Fraud Recovery has a number of positive reviews dating back to May 2017 when in fact they only came into existence approximately one month ago. These are the type of scams victims are facing after they have already been scammed once.

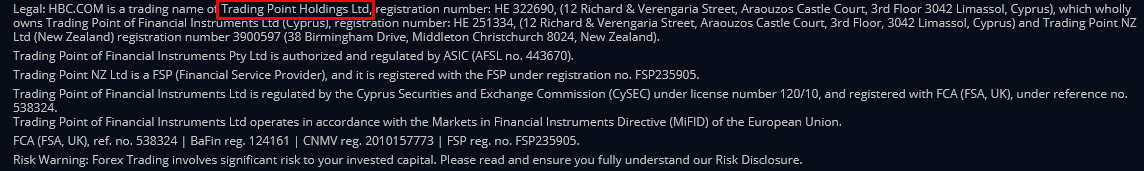

Another website, Optionsrefund, lists its address as being in Christchurch, New Zealand and provides users with a US contact number. The site, however, was registered in Canada and the person that set it up did not provide any name or contact information. Trying to figure out who runs these sites is challenging but, in a number of cases, we can certainly tell that they are not based where they claim.

Beware of those non-regulated fund recovery services

The online trading industry is fraught with non-regulated brokers such as Greenfields Capital to KayaFX masking to be legitimate financial service providers. The same stunt is being pulled in the fund recovery industry. These companies dupe their hapless clientele by claiming to have incriminatory intel against these scam brokers and charge an upfront fee in order to get the case off the ground require up-front, with the minimal likelihood of ever seeing that money again. Remember it is not the initial payment that is problematic as almost all legitimate companies in any industry require some sort of a down payment. This is especially true in the fund recovery business as it is not a given that they will be able to recover the money as there are so many mitigating factors that go into each and every case.

A number of these fake recovery companies even offer state of the art hacking services. Take Binary Options Recovery Specialist, their hacking services include password recovery and credit score editing in addition to their binary options recovery resources. Anyone who wants to utilize any of their services must also pay in some form of cryptocurrency – making it practically impossible to determine where the money is actually being sent.

How can this be prevented?

There is one predominant factor that is driving these scam websites. Those that have lost money from binary options and other online trading scams are generally desperate. These are not multi-billionaires or millionaires who can stand to lose a few hundred thousand dollars or pounds but regular individuals who probably forfeited their whole life savings.

Anyone in that unfortunate situation is almost always desperate for assistance especially when the regulators and other authorities are often at loss as to how to take down these scammers as they are often located offshore. This is where the recovery scam artists come in as they claim they have the necessary capabilities to pursue these binary options and forex brokers.

Preventing such people from operating seems like a Herculean task. Those that own the sites are often difficult to find and, as soon one is shut down, another pops up somewhere else along with a recovery firm targeting those victims. However what you can do is alert us at the Broker Complaint Registry, the financial ombudsman, your banks, social media and everyone in between. Additionally, when you submit a complaint to us we will review it and put you in touch with a regulated fund recovery service or lawyer that specializes in financial fraud.

Listed below are seven scam recovery companies that we have received complaints against. If you were a victim please submit your complaint here. Obviously, there are additional fraudulent recovery companies that are operating if you are aware of them please send us an email at [email protected] and we will do our best to spread the word

- Capital Chargeback

- Optionsrefund

- Finance Fraud Recovery

- Binary Option Asset Recovery

- Financialchargeback

- First Options Recovery

- WorldTradersRecovery